27 Nov Has your income risen by 14.3% over the past year?

Statistics show that dividends from UK shares are still rising rapidly.

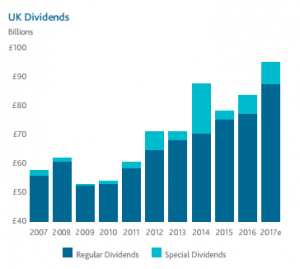

Source: Capita Asset Services. Overall 2017 figure is Capita estimate

The latest quarterly ‘UK Dividend Monitor’ from Capita Asset Services paints a rosy picture for income-seeking investors in UK shares. As Capita noted, “Companies are very cash-generative, which is strongly supporting dividend payments… The easy gains from the pound’s devaluation, where dividends declared in dollars or euros were translated at much more favourable exchange rates, are now behind us, but the profits of those companies with a UK cost-base and overseas markets for their goods and services can continue to benefit.”

Capita’s number crunchers calculated that in the third quarter of 2017:

- Total dividends from UK shares were 14.3% higher than in the third quarter of 2016.

- Special (one-off) dividends rose by two fifths, year-on-year.

- Stripping out the special payments, underlying (regular) dividends were 13.2% higher.

- Whereas sterling’s weakness boosted dividend increases in the first two quarters, it made virtually no difference in the latest figures. Adjusted for currency, underlying dividends were up 12.9%, the fastest quarterly rise since 2012.

In July Capita was projecting 2017 annual underlying dividend growth of 7.4%, but it has now pencilled in a figure of 11.1%. For 2018 it sees dividend growth as “unlikely to be as dramatic”, mainly because “the froth of exchange rate gains will be gone”.

Capita notes that “Equities remained comfortably the most attractive of the main asset classes for income, as they have for several years now.” If your goal is to generate income from your investments, why not talk to us about your routes into UK shares?

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

No Comments